Your definitive guide to deal lifecycle management in corporate banking

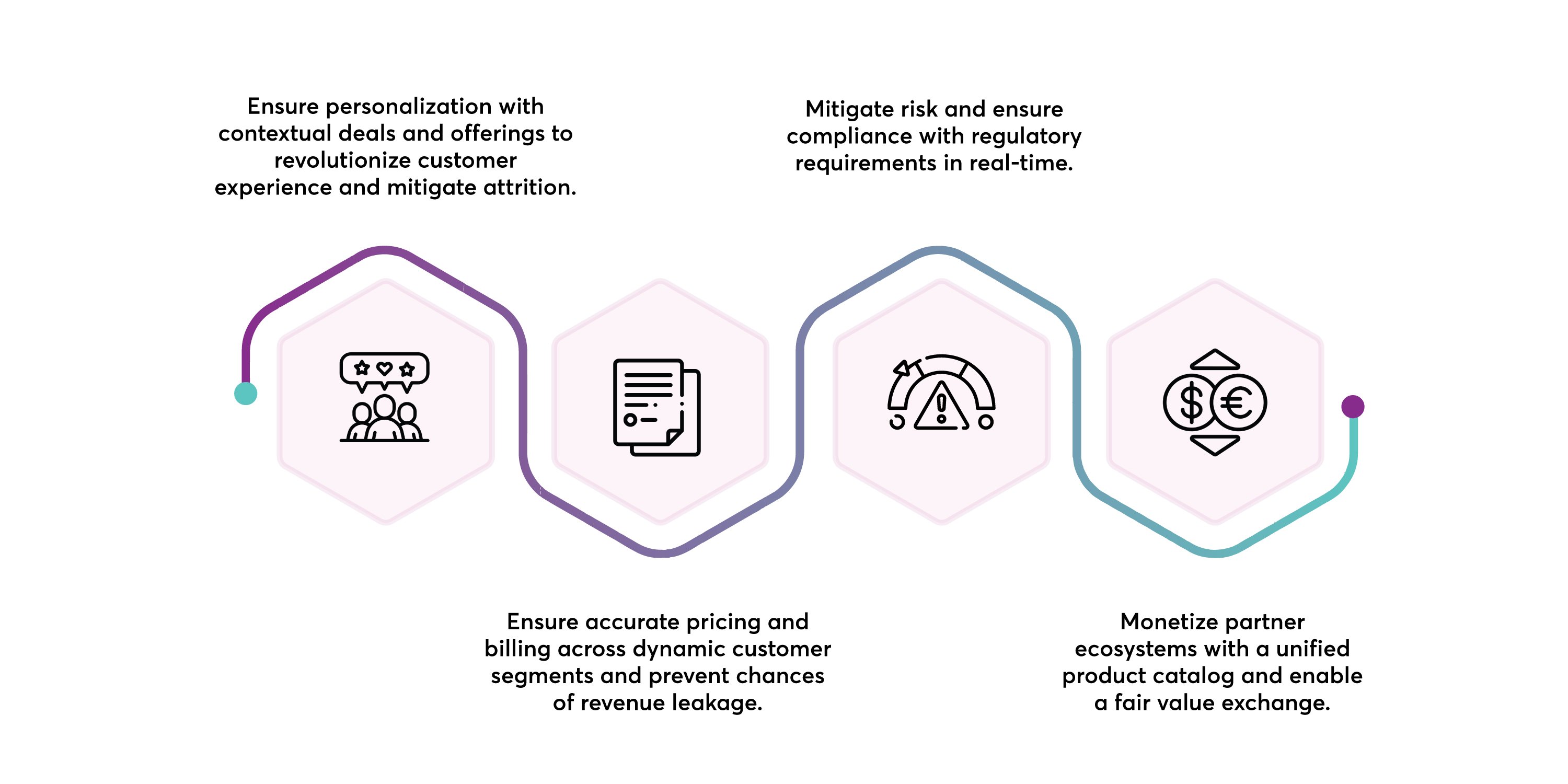

The corporate banking landscape requires a rethink of strategy to become customer centric while ensuring profitability. Banks that lack the right deal and revenue management tools face a higher risk of revenue leakage, lost margins and eroding customer trust.

Now solve your corporate customer’s challenges by offering differentiated deals. Discover how to engage customers better with deals that offer value, plug revenue leakage, and grow your relationships.

75% of transaction operations and 40% of strategic functions can be automated, suggests a McKinsey study.

How can you find the right revenue management solution for you? Discover 8 must-have features that make a robust revenue management solution and boost your efficiency with the power of automation!

One of the world’s largest banks revamps its revenue management process; plugs 6-8% of revenue leakage

SunTec helped the bank:

- Plug revenue leakage amounting to 6-8% of total revenue

- Achieve ROI quickly

- Improve their corporate banking processes and consolidate operations across countries

Ensure seamless revenue collection without disrupting customer experience with event-driven revenue management. Ensure seamless revenue collection without disrupting customer experience.

Discover the components of an effective revenue management system and how a customer-centric strategy backed with the right technology can help plug revenue leakage.

Why Choose SunTec

Pioneers in technology solutions for Relationship-based Pricing and Billing

Vast experience: 130+ clients in 45 countries

Experience in delivering 4X increase in deposit growth for our customers

Flexible delivery models – On-Premise, Cloud, SAAS

%20(1)%20(1).jpg?width=200&height=53&name=SunTec-Logo_high-res%20(1)%20(1)%20(1).jpg)